Janet, Raj and the rise of automation - How Personal Software will change enterprise work

Businesses want to make money. Employees are there to help the business achieve its goal. Those doing knowledge work use multiple SaaS tools to do their work. In enterprise, LLM's are rewriting the rules. It's time to call it. LLMs are eating the world.

But bubble, I hear you say. AGI, whatever that means, isn't of extreme interest to me. But the LLMs we have as of right now, with strong scaffolding can massively accelerate the quantity, quality and speed of work in enterprise. And this doesn't bode well for a large section of SaaS today. But there are untold billions to be made in the upcoming compression of the enterprise SaaS layer.

Something fundamental is changing in how enterprises build software and who builds it.

We've been automating enterprise workflows over the past year, and many of them actually work. Not just "works in the demo" but actually work where people immediately use it and start demanding more of it. CV screening, fraud checks, support ticket routing, data quality checks. Every enterprise workflow can be automated to an alarming degree.For most of the LLM revolution, the models have promised the moon and broken in staging. But now, many of these solutions actually work. LLM evaluations sitting at clear decision nodes in workflows, armed with clear rubrics, human review on edge cases, logs that feed back into eval dashboards.

Note: The gap from demo to production is actually quite hard and takes more time than expected. I like to say that the last 10% takes half the time. Evaluations, testing and implementation with strong HITL that actually improves the system is still an unsolved problem at scale, with most product teams doing active discovery in areas like LLM gateways, evals, traceability, prompt management and more.

Something fundamental is changing in how enterprises build software and who builds it.

Everyone's Bob the builder now

Personal Software is what I'm calling this shift. Previously, automating an enterprise workflow meant choosing between two unsatisfying options. You either spent a quarter or more on brittle regex systems that broke on every edge case. Or you scoured 20 providers, navigated 10 emails from each of them, got overwhelmed by the feature comparison and bought a SaaS tool you eventually regretted. In a couple years, it often was "We forgot why we bought this tool, but the process dependent on it is now too deeply embedded in our workflows to rip out."

Monday.com is a prime example. What was supposed to be a simple way for teams to organize work became an extremely bloated product that often adds more confusion to day-to-day work than it solves. Most companies would be better off building a simple kanban board in-house and using/extending it however they wanted with MCP connectors. Every additional SaaS integration brings real, often-underappreciated costs: data silos, process contortion, and that last-mile integration hell between systems. You end up bending your actual workflow to fit the tool's assumptions because the vendor built for everyone, features that your workflows don't need end up cluttering your processes.

But LLMs now are allowing companies to reconsider the build v buy calculation. The rules of the game change when you can replace brittle rules with fuzzy logic that's good enough and when you can iterate a rubric faster than you can negotiate a vendor contract. Workflows on the edge start unbundling. As an enterprise customer, my appetite for point SaaS solutions has diminished significantly. I'd rather build a small internal tool that automates some of my ops team's workflows than buy an individual point SaaS solution where I'll have to deal with seat-based pricing, figure out ROI, trawl through 20 different pricing pages, all for a ShadCN UI with enterprise billing slapped on top of a fancy Excel sheet.

Why now?

The cost curve collapsed. LLM's, from a business context, are intelligence in a bottle that you pay micro-cents for. When intelligence gets cheap, many enterprise workflows start getting automatable. LLMs may or may not get to AGI. But they can now handle the narrow, repeatable intelligence that powers individual nodes inside many enterprise workflows.

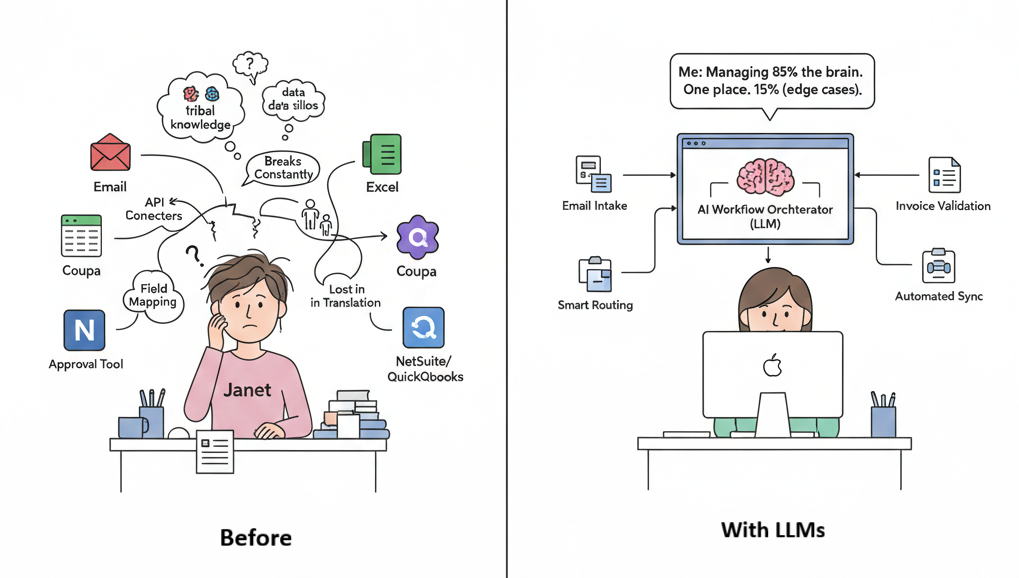

Consider invoice processing at a mid-sized company. Janet receives an invoice via email. She downloads the PDF, checks if it looks legitimate, logs it in an Excel tracker with vendor name, amount, and due date. She copies that information into the company's approval tool, call it Coupa. Coupa then routes it to Raj for approval based on amount thresholds. Raj reviews it in Coupa, approves it, and someone (often Janet again) manually enters the approved invoice into QuickBooks or NetSuite. Finally, Janet reconciles everything back in Excel to track payment status. 2 people, one consistent workflow and 4 tools. This workflow is often not documented and is mostly tribal knowledge.

Zoom into any of those steps and most aren't creative work. They're monotonous transformations and validations. The more interesting problem is what happens when you scatter a workflow like this across multiple SaaS tools. Each tool owns a piece of the process, none of them talk to each other cleanly, and the actual logic of how invoices should flow lives partly in tool configurations, partly in Excel formulas, and mostly in Janet's head. She knows that invoices from certain vendors need special category codes. She knows which amount thresholds trigger which approval chains. Tribal knowledge.

This fragmentation is what kills automation attempts. You'd need custom API connectors between each tool pair. Field mappings break constantly. Invoice number 123 in Excel becomes PO Reference in Coupa becomes Transaction ID in NetSuite, and someone has to maintain that mapping. When you want to change the workflow, if you want to add a new approval step for international vendors, you'd have to reconfigure three different systems and update Janet's mental model. The ideal workflow gets lost in the last mile value delivery between tools. For the enterprise, these SaaS tools are just a means to get the actual job done: process the invoice, pay the vendor, maintain records. But the tools themselves become the obstacle.

What changes with LLMs is that Janet can now manage an automated workflow instead of manually executing each step. The LLM reads the email, validates the invoice against historical patterns, extracts the data, routes based on the rubric (including those special cases Janet used to handle manually), updates the systems, flags edge cases for her review. One person, one tool, human oversight on the 15% that needs judgment. The workflow logic lives in one place. The enterprise owns it. And when they need to change the rules, they update the rubric instead of reconfiguring three vendor systems.

Owning the workflow data matters. This is underappreciated. Your CV screening criteria, your invoice approval logic, your support ticket triage rules; this is the proprietary workflow knowledge that powers your company. Building a tool around your data often beats integrating a generic tool that approximates your process. Every workflow gets its own dashboard: acceptance rate, escalation rate, latency, safety checks. That dashboard becomes the ops console and proof to stakeholders that this thing actually delivers value. If you've read my data wall piece , this is the sequel. Instead of Goodhart-Law-coded benchmarks, enterprise workflow evals are what increasingly matter.

The rise of the problem solver - aka Forward Deployed Engineer and his alter egos

LLMs are a deflationary force on enterprise operations. Large departments in enterprise are beginning to grapple with extreme changes in how things are done. Crack teams with 2-3 people, strong problem-solving skills and a handful of LLMs can now do what previously needed a large team. Whether this results in actual downsizing or work morphing into higher-leverage activities: we don't know yet. Enterprises are slow. They're still figuring out how to reorganize around this, who internally can actually leverage these tools effectively, what to build versus what to buy. But the pressure is real across the industry.

Market impact notes

Vendor pricing models are breaking. When an AI agent does the work, seat-based pricing makes no sense. Companies like Intercom and Salesforce have shifted to outcome based pricing. Customers now pay per ticket resolved, per task completed, per invoice processed. But only 17% of enterprise SaaS vendors have implemented this yet. The lag creates opportunity for anyone willing to price around outcomes instead of seats.

The middle layer is getting squeezed. Not all SaaS dies. Services with deep proprietary data, network effects, or regulatory moats survives. Infrastructure platforms survive. Everything else: generic workflow SaaS that kind of fits your process but not really; their days are numbered. 37% of enterprises now run five or more specialized AI models for specific workflows instead of one horizontal tool.

Capital is flowing toward infrastructure and intelligence. Less spending on horizontal SaaS subscriptions. More spending on foundation model API calls, infrastructure, and eval tooling. McKinsey projects $5.2 trillion investment in AI data centers by 2030 just to meet compute demand. That's where enterprise budgets are flowing: infrastructure and intelligence, not approximated workflows.

What this means

What it meansBrendan Foody, the Mercor CEO, told Lenny Rachitsky in September that we're entering the "era of evals"—where evaluations become the PRDs, the sales collateral, even the product itself. He's right. Evals are what make Personal Software possible. You can't ship narrow AI tools without workflow-native measurement. The eval is the product.

If you've read my data wall piece, this is the sequel. Instead of Goodhart-Law-coded benchmarks, enterprise workflow evals are what matter. Clear rubrics, measurable outcomes, dashboards that prove value to stakeholders.

More edge SaaS loses to internal builds over the next 3–5 years. I'd still bet on the SaaS tools that are core systems of record, infrastructure, platforms with real network effects. But the approximated middle layer—where vendors tried to be all things to all customers—gets replaced by Personal Software. Narrow tools built for specific workflows, grounded in proprietary data, measured by workflow-native evals.

Winners will be companies that ship agent-native platforms or sell eval infrastructure. Buyers will run a portfolio: infrastructure SaaS for the heavy lifting, Personal Software for edge workflows, specialized tools where domain expertise matters more than generality. Infrastructure and specialized platforms at the top and bottom survive and grow. Generic workflow SaaS in the middle gets squeezed until it unbundles or transforms.